Trump Powell Termination Comment Sparks Market Tensions

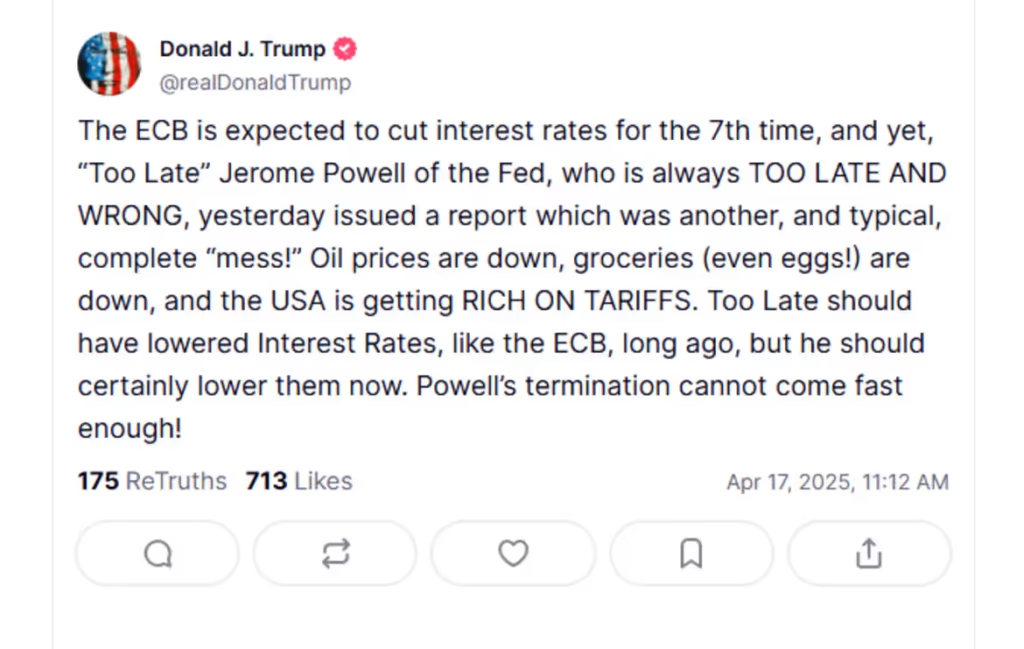

Former President Donald Trump has reignited his long-running feud with Federal Reserve Chairman Jerome Powell, declaring that Powell’s “termination can’t come fast enough” in a blistering comment that has stirred fresh controversy on Wall Street and in Washington. The Trump Powell termination comment came amid heightened market anticipation for Netflix earnings and ongoing speculation around interest rate policy.

As stock markets opened cautiously higher Tuesday morning, Trump took to social media and campaign stops to criticize Powell’s leadership, accusing him of “destroying the American economy with his incompetence” and labeling him as “more dangerous than Biden’s border crisis.” The statement came just hours before the tech-heavy Nasdaq led gains across indexes, and ahead of Netflix’s earnings release—putting Powell once again in the center of political and financial crosshairs.

Powell’s Fed in the Crossfire Again

Jerome Powell, appointed by Trump in 2018 and later reappointed by President Joe Biden, has faced harsh bipartisan scrutiny over the past two years due to persistent inflation, rapid interest rate hikes, and what critics describe as a “lagging” response to economic shifts. However, Trump’s latest outburst took the criticism up a notch.

In a quote highlighted by MarketWatch, Trump blasted:

“He’s a political liability, and frankly, his termination can’t come fast enough.”

That language, rare and inflammatory even by Trump’s standards, quickly made headlines. The Financial Times also reported that Trump privately considers Powell a “catastrophic mistake” who should have been replaced during his presidency.

Why Is Trump Going After Powell—Again?

Trump’s renewed attacks come at a strategic moment. With the 2024 presidential campaign heating up, Trump is aiming to make the economy a central theme. By blaming Powell for inflationary pressures and interest rate hikes, he’s laying the groundwork to pin economic pain on Democrats—while also revisiting grievances from his own time in office.

During his first term, Trump often clashed with Powell over interest rate policies, demanding cuts even when the Fed deemed them inappropriate. Despite the friction, Trump never removed Powell—likely due to legal and political constraints. Still, his consistent messaging has turned Powell into a convenient scapegoat for inflation, high borrowing costs, and shaky markets.

Can Trump Actually Fire the Fed Chair?

Not directly. Under U.S. law, the Federal Reserve operates independently, and the president cannot fire the chair without cause—specifically “neglect of duty” or “malfeasance.” Any effort by Trump to force Powell out would trigger a legal and political firestorm, potentially undermining confidence in the Fed’s autonomy.

However, if Trump were re-elected in 2024, Powell’s term as chair ends in May 2026, opening a potential path for Trump to refuse reappointment or push for his resignation under pressure. That timeline could set up a dramatic clash over monetary policy in a second Trump administration.

Market Reactions: Shrug or Shock?

So far, the markets seem largely unshaken by the rhetoric. The Dow, S&P 500, and Nasdaq all opened slightly higher, reflecting more interest in upcoming corporate earnings—especially Netflix—than in political commentary. However, seasoned traders are keeping one eye on Trump’s words and another on potential future Fed interventions.

As a MarketWatch analyst noted:

“The markets are used to Trump bombshells. What matters more is whether his words signal policy changes or personnel shifts if he returns to office.”

Still, some investors worry that continued politicization of the Fed could damage its credibility, affect long-term inflation expectations, and erode investor trust.

Trump’s Broader Economic Playbook

Trump’s assault on Powell fits into a broader strategy to blame current economic uncertainty—rising interest rates, housing instability, and recession fears—on the Federal Reserve’s tightening cycle. In campaign speeches and interviews, he has suggested he would favor more accommodative monetary policy, potentially pressuring the Fed to cut rates sooner and stimulate growth.

It’s worth noting that Powell’s Fed has made it clear: their decisions are based on data, not politics. But with election dynamics heating up and inflation not yet fully under control, the political pressure on Powell is only likely to grow.

FAQs

What did Trump say about Jerome Powell?

Trump said Powell’s “termination can’t come fast enough,” criticizing him for damaging the U.S. economy with his monetary policies.

Why is Trump targeting the Fed Chair again?

Trump is using Powell as a symbol of economic mismanagement ahead of the 2024 election, blaming him for inflation and rate hikes.

Can Trump fire Jerome Powell?

No, the Federal Reserve Chair cannot be fired without cause. However, if re-elected, Trump could decline to reappoint him after his term ends in 2026.

How has the market reacted to Trump’s statement?

Markets opened higher and seemed unfazed, focusing more on corporate earnings, particularly Netflix, than Trump’s comments.

What’s the significance of Trump’s comment?

It signals a potential politicization of the Fed in a future Trump administration and raises concerns over central bank independence.

When does Powell’s term end?

Jerome Powell’s current term as Fed Chair ends in May 2026.

Conclusion: Political Rhetoric Meets Economic Policy

The Trump Powell termination comment is more than just another soundbite—it’s a strategic chess move in the high-stakes game of economic narrative control. With interest rates still elevated, inflation stubbornly sticky, and consumer confidence wavering, Trump is reviving his old playbook: create a villain, hammer the message, and claim he alone can fix it.

Whether or not Powell stays in place, the pressure on the Fed is building. And as the 2024 election season barrels forward, the line between political theater and financial policy may get thinner than ever.

3 thoughts on “Powell Under Fire: Trump Wants Him Out Fast”